Oklahoma Tax Rates 2025. Calculate your income tax, social security and. The oklahoma sales tax rate is 4.5% as of 2025, with some cities and counties adding a local sales tax on top of the ok state sales tax.

Updated for 2025 with income tax and social security deductables. 609 rows 2025 list of oklahoma local sales tax rates.

Oklahoma has a 4.50 percent state sales tax rat, a max local sales tax rate of 7.00 percent, and an average combined state and local sales tax rate of 8.98 percent.

How OKLAHOMA Taxes Retirees YouTube, Sales and use tax rates will change effective jan. 8 announced sales and use tax rate changes for cities, towns, or counties.

Oklahoma BAH Rates 2025 Fort Still, Tinker AFB BAH, & More, 1 published the 2025 income tax withholding tables, effective jan. Tax rates range from 0.25% to.

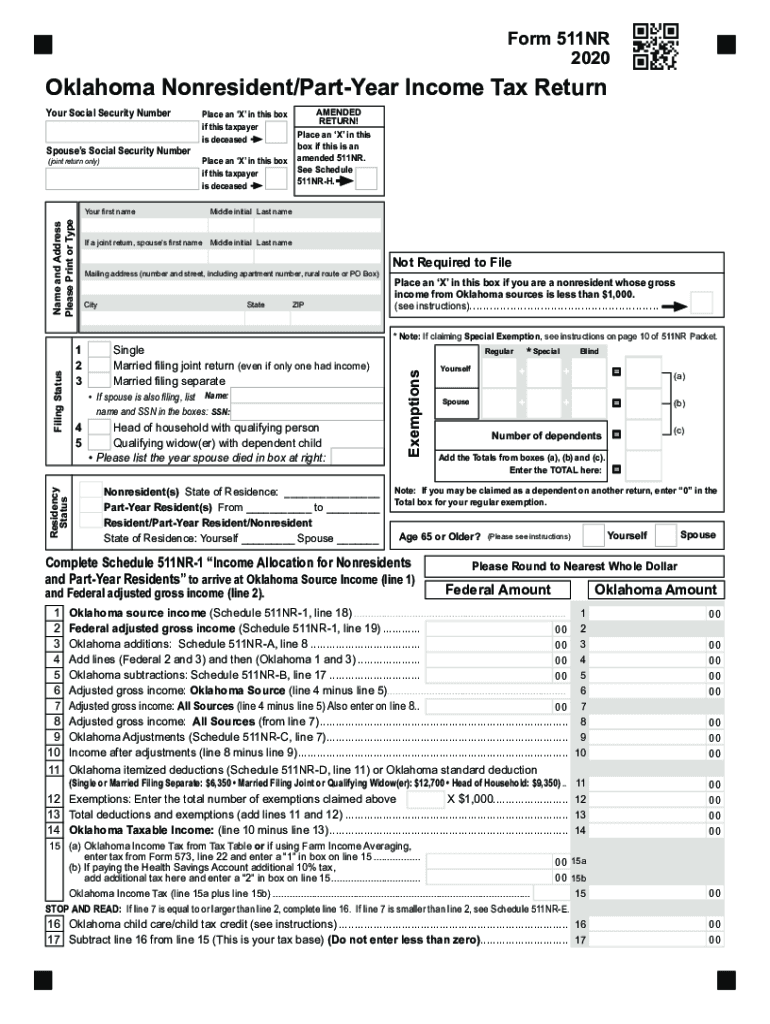

Oklahoma Tax Form 2025 Printable Forms Free Online, 2) the sales and use tax rate in wewoka increases to 5.25. The following features are available within this oklahoma tax calculator for 2025:

Oklahoma Tax 20222024 Form Fill Out and Sign Printable PDF Template, The following features are available within this oklahoma tax calculator for 2025: For the 2025 tax year, oklahoma’s top income tax rate is 4.75%.

Oklahoma Sales Tax Guide for Businesses, The oklahoma tax calculator includes tax years from. Tax rates range from 0.25% to.

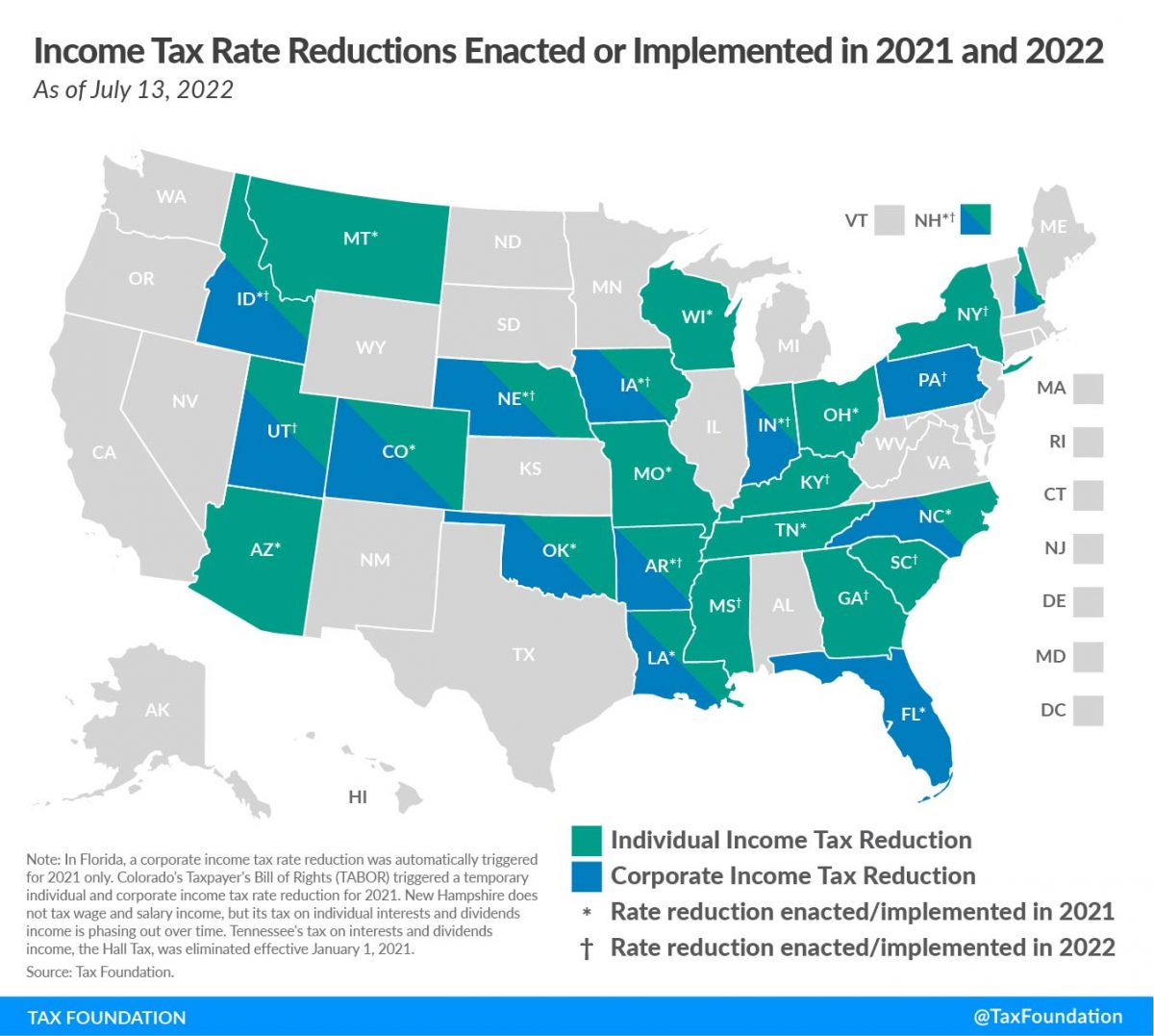

2025 State Tax Reform & State Tax Relief Rebate Checks, The oklahoma sales tax rate is 4.5% as of 2025, with some cities and counties adding a local sales tax on top of the ok state sales tax. For the 2025 tax year, oklahoma’s top income tax rate is 4.75%.

State Sales Tax Oklahoma State Sales Tax, 8 announced sales and use tax rate changes for cities, towns, or counties. The average effective property tax rate in oklahoma is 0.90%, with a median annual tax assessment of around $1,228 on a $136,800 property.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/10615433/top_rates.png)

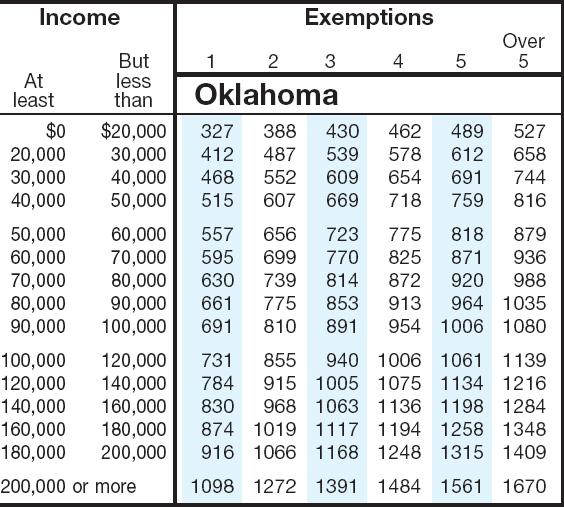

Oklahoma teacher strike how a decade of tax cuts for the rich hurt, The average effective property tax rate in oklahoma is 0.90%, with a median annual tax assessment of around $1,228 on a $136,800 property. This page has the latest oklahoma brackets and tax rates, plus a oklahoma income tax calculator.

Tax Rates Sunset in 2026 and Why That Matters Barber Financial Group, Tax rates range from 0.25% to. With six marginal tax brackets based upon taxable income, payroll taxes in oklahoma are progressive.

Tax rates for the 2025 year of assessment Just One Lap, Oklahoma's 2025 income tax ranges from 0.25% to 4.75%. Average sales tax (with local):

The oklahoma sales tax rate is 4.5% as of 2025, with some cities and counties adding a local sales tax on top of the ok state sales tax.